New MSME definition announced by GoI. Effective 1st April 2025! Please see link: https://udyamregistration.gov.in/docs/261838_220191.pdf

New MSME definition announced by GoI. Effective 1st April 2025! Please see link: https://udyamregistration.gov.in/docs/261838_220191.pdf

Invoicemart is the brand under which A.TReDS Ltd offers all its products and services.

It is a digital platform based on Trade Receivables Discounting System (TReDS), which is a system instituted by the RBI to improve cash flows to MSMEs through factoring (and reverse factoring).

Invoicemart connects buyers, MSME sellers and financiers so as to ensure MSMEs receive quick payments for their invoices.

A.TReDS Ltd. is a joint venture between Axis Bank and mjunction services, which has been licenced by the RBI to operate its TReDS (Trade Receivables Discounting System) platform, under the Payment and Settlement Systems Act, 2007.

The objective of Invoicemart is to facilitate financing of invoices of MSMEs drawn on their buyers by way of factoring.

Suppliers categorised as MSMEs, corporate buyers and financiers (banks/NBFC factors) can participate on Invoicemart.

Factoring is a process which enables suppliers to reduce the payment period for their goods/services. It does this by introducing a financier between the supplier and the corporate buyer. The financier finances the supplier against the invoice/bill of exchange raised on the corporate buyer for the goods/services provided by the supplier.

In reverse factoring, a buyer raises an invoice, as opposed to factoring in which a seller raises the invoice on the system. The financier finances the supplier against the invoice/bill of exchange raised on the corporate buyer for the goods/services provided by the supplier.

Yes. The platform shall facilitate receivables factoring and reverse factoring.

Yes, the platform is for MSMEs from both manufacturing and services sectors.

Traditional invoice discounting usually involves a tripartite agreement between a buyer, seller and financier. Thus every buyer-seller-financier combination requires a different agreement, which is cumbersome.

KYC documentation shall be in line with the documentation/verification done by the banks as per the existing regulatory requirements.

If you’re a corporate buyer, an MSME supplier, or a bank/NBFC factor, yes you can participate on Invoicemart.

The facility is limited to MSME sellers who are referred by their corporate buyers registered with Invoicemart. If you’re a financier, you must have a factoring licence from the RBI. There is no restriction on buyers, but you need to have MSME suppliers.

You can register online. Alternatively, you can also download the account opening form, master agreement and relevant annexures and share the filled up form with us at the communication address of Invoicemart.

Each participant needs to execute the Master Agreement with TReDS. The key highlights of each agreement are detailed in subsequent sections. Invoicemart shall be the custodian of all master agreements.

You can become a guest user now and register yourself by following this link.

The guest user link remains valid for 15 days. You should ensure that the form is filled up and the pre filled account opening form is generated within the given time frame.

No, you will not be able to reactivate the guest user link once it expires. You’ll have to create a new guest user profile to register yourself.

Yes. You may need to submit the request for retriggering the link from your registered email address to helpdesk@invoicemart.com You can also call up on 022 - 6235 7373/6235 7379/ 4975 7373 and request for the same.

To transact on Invoicemart, you need to be registered with us as a buyer, seller or financier. You will be given an account login ID with which you will be able to sign in and transact on the platform.

The financial instrument used for trading is your invoice/set of invoices (or bill of exchange). The platform captures all necessary details of the invoice in a digital format, which converts it into a factoring unit.

It refers to an invoice/set of invoices (or bill of exchange) that has been uploaded on the platform in a digital format.

Factoring unit(s) can be created either by the MSME seller (in case of factoring) or by the buyer (in case of reverse factoring).

The factoring unit(s) has to be accepted on the platform by buyers. However, in case of reverse factoring when a buyer agrees to bear the interest, pre-accepted FUs will be uploaded by the buyer on the platform.

The FU details are shared with registered financiers for bidding.

Yes the minimum amount for creation of factoring unit is INR 5,000 (Five thousand only).

| FU creation | FU Acceptance | Bidding | Bid Acceptance | ||||

|---|---|---|---|---|---|---|---|

| From | to | From | to | From | to | From | to |

| 9 am | 9 pm | 9 am | 9 pm | 9 am | 9 pm | 9 am | 9 pm |

Invoicemart shall conduct random audits to confirm the authenticity and genuineness of transactions involving the sale of goods and services.

Invoicemart does not offer any guaranteed settlement and does not take any settlement risk. It is a platform which facilitates factoring/reverse factoring transactions.

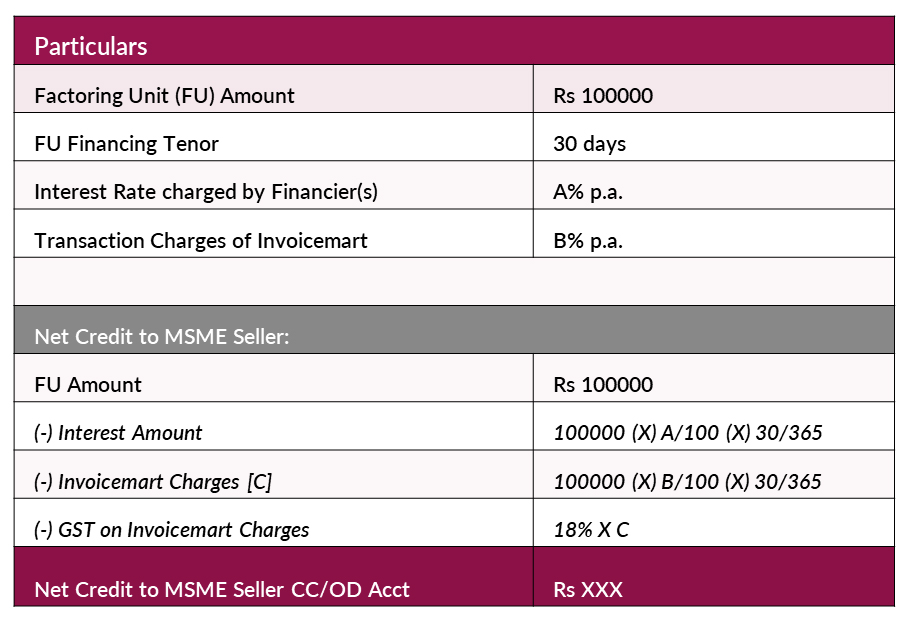

You may incur the following costs associated with factoring/reverse factoring on Invoicemart:

For the purpose of automatic settlement, Invoicemart shall obtain NACH mandates from both buyers and financiers.

The buyer means any entity that purchases the goods and/or avails the services offered by micro, small and medium enterprises (as defined in MSME Development Act, 2006) for a consideration.

Factoring is a financial arrangement whereby a specialist finance company (the factor) purchases the debts of a firm for an amount less than the book value of those debts. The firm benefits by receiving immediate cash from the factor and avoids the trouble and expense of pursuing tardy debtors. Each transaction is considered as one factoring unit.

If you purchase goods/services from MSMEs, you can register on Invoicemart.

To participate, you just have to sign a one-time master agreement with A.TReDS Ltd, which operates the Invoicemart platform. No hassles of entering into multiple factoring agreements. A.TReDS Ltd enters into a similar master agreement with other participants such as financiers and sellers.

A - CONSTITUTION-WISE DOCUMENTS

Limited/Pvt. Ltd. Company

LLP

Trust/Society

Partnership Firm

Sole Proprietorship Firm

HUF

B - COMMON DOCUMENTS FOR ALL

Address Proof of the Entity

Documents required:

Invoicemart shall debit the financier’s account for the net factoring unit value (factoring unit amount minus financier’s charges) and credit the seller’s account on ‘T+1’ day (‘T’ is the Bid Acceptance day) through National Payments Corporation of India. Invoicemart shall debit the buyer’s account with the factoring unit value and credit financier’s account on the due date. For the purpose of automatic settlement, Invoicemart will obtain the buyer’s National Automated Clearing House (NACH) debit mandate during the onboarding process.

Invoicemart attempts the settlement on due date and the next two working days. If the settlement fails, it will be treated as a default and needs to be settled bilaterally between the buyer and the financier.

An MSME seller is a micro, small or medium enterprises (MSMEs) registered under the Udyam Registration Portal of the Government of India. As per the revised classification, MSMEs are defined as follows:

We would require Udyam Registration Certificate to confirm entity’s MSME status. Pls get the certificate by applying on https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm

A financial arrangement whereby a specialist finance company (the factor) purchases the debts of a firm for an amount less than the book value of those debts. The firm benefits by receiving immediate cash from the factor, and avoids the trouble and expense of pursuing their debtors.

Any MSME can register provided they meet the following two conditions.

MSMEs can submit their application for onboarding/registration both online and offline. List of documents is as detailed below:

Please submit your online form by logging into www.invoicemart.com and click on NEW/RESUME Registration. Pls create login credentials (or) use existing if resuming registration. The online form will open and you can submit the relevant details, documents etc

Please refer the link - https://udyamregistration.gov.in/Government-India/Ministry-MSME-registration.htm. Government has made it mandatory for all MSME vendors to get this certificate. It is free of cost and certificate can be got instantly.

You can use a calculator like the one shown below to check

In the rare case that no acceptable/competitive bids are received for FU, the seller can choose not to accept the bid against the FU. In such a scenario, the FU will remain unfinanced on the platform and buyer can make direct payment through the platform.

(a) For micro and small enterprises - max tenor can be 38 days from date of acceptance of invoice by buyer on the platform.

(b) For medium enterprises - max tenor can be 180 days from date of acceptance of on invoice by buyer on the platform

Post onboarding or registration login credentials will be triggered to the REGISTERED EMAIL ID's of the Authorized Signatories /Users provided in the Application Form.

To register, the seller needs to submit application form, submit KYC docs, sign a one-time master agreement with A.TReDS Ltd, which operates the Invoicemart platform and submit Udyam Registration Certificate. No hassles of entering into multiple factoring agreements.

The key highlights include:

Yes. The seller is required to submit details of the working capital bank account (CC/OD) as the proceeds will be credited to this account. The seller who has CC/OD account has provided the bank a charge over your stock and receivables. Invoices discounted and getting paid through TReDS platform - Invoicemart is part of those receivables. Hence, we need to credit CC/OD account to let the bank know that receivables have been converted into cash.

In case the seller doesn’t have a working capital relationship with any bank, the seller can provide the current account details.

In case the payment from the financier to the seller fails the transaction will stand cancelled. The buyer can then decide to make direct payment for the FU through the platform

No. The seller doesn’t incur any repayment liability once the invoice is accepted by the buyer. There is no recourse on the seller as per the TREDS Guidelines. Link for the guidelines - https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=3504

It refers to banks, NBFC factors, and such other institutions as may be permitted by RBI from time to time to participate in the TReDS platform as Financiers.

A financial arrangement whereby a specialist finance company (the factor) purchases the debts of a firm for an amount less than the book value of those debts. The firm benefits by receiving immediate cash from the factor, and avoids the trouble and expense of pursuing their debtors.

You could register on the Invoicemart platform in the following ways:

Contact the Financier Management Team from the given link

Or

By clicking here to commence registration.

It depends on the constitution of your entity. Please visit the Contact Us page to get in touch with our team.

The financiers shall bid for the factoring units (FUs) on the platform and make funds available for settlement.

You can choose to bid in multiple ways:

No. The financier needs to enter into a one-time Master Agreement with A.TReDS Ltd to participate on the platform.

Yes. While the buyer has the right to pre-pay, the financier has the discretion to accept and negotiate terms with the buyer.

Once the factoring unit (FU) is accepted by the buyer, the buyer cannot extend the repayment period.

The 'Notice of Assignment' shall be sent to the corporate buyer electronically by Invoicemart upon settlement of funds by the financier to the MSME seller.

In the event of a delay/default in repayment by the buyer, the financier can initiate legal action against the buyer.

Yes. While the buyer has the right to pre-pay, the financier has the discretion to accept and negotiate terms with the buyer.

Documents required: